The profitability index is used as an appraisal technique for potential capital outlays. However, the PI disregards project size when comparing project attractiveness. Therefore, projects with larger cash inflows may result in lower profitability index calculations because their profit margins are not as high.

Why Measuring Profitability Index is Crucial for Your Business

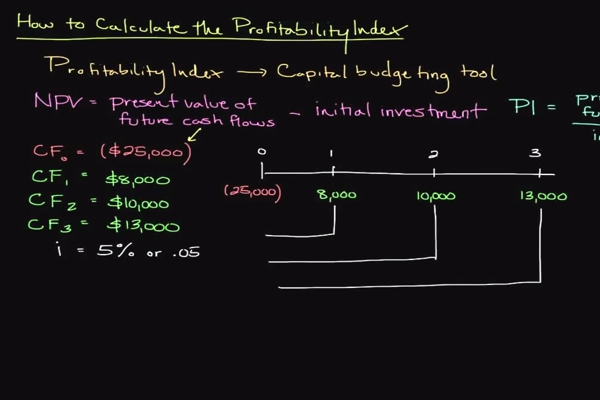

The profitability index, in fact, is another way of representing the net present value model. The only difference between two is that the NPV shows an absolute value whereas the PI measures the relative value in ratio format. Rigorous scenario analysis and comprehensive risk assessment must accompany the use of PI for it to be truly effective in our financial decision-making toolkit.

How to calculate profitability index in Excel

PI and NPV are said to be directly proportional where positive NPV leads to PI that is greater than, while a negative NPV means a PI lower than 1. Profitability index helps businesses assess their ability to make money and this is what makes it one of the most important metrics for estimating profits over a period efficiently. However, even if the PI is widely used for doing cost-benefit analyses, it is not free of demerits. As every good side has its limitations, PI also has a couple of limitations.

Profitability Index (PI) Rule: Definition, Uses, and Calculation

The Profitability Index and Net Present Value are closely knitted concepts in finance, yet they offer distinct perspectives. NPV provides an absolute measure of an investment’s value by calculating expected cash flows minus the initial outlay. In contrast, PI offers a relative measure, indicating the value created per dollar invested. It’s the difference between knowing the total profit (NPV) and understanding the efficiency of your investment (PI).

What Is the Profitability Index? Definition & Calculation

The best I like about Profitability index is that it allows comparison among multiple investments of varying sizes and tenures in relative terms. The only tricky part of calculating PI is the discounting of cashflows to reach the present value of these cashflows. However, since Excel offers multiple inbuilt functions a complete guide to california payroll taxes for that job, it will still be super easy. Profitability Index is a great metric to use when you need to decide whether you need to invest in something or not. If you have a company and you are on a tight budget, this metric helps you decide whether you should consider investing in a new project or not.

Limitations of profitability index (PI)

The outcome is our Profitability Index, conveniently calculated through the power and precision of Excel. Essentially, it quantifies the bang for your buck for each unit of currency invested. Since you’ll be able to earn more than what you invest, the PI for this project is 1.56 (more than 1). A negative number divided by a positive number results in a negative output. Once you start looking into how it is calculated and interpreted – it will make more sense. From the above computation, we can come to the conclusion that ABC Company should invest in the project as PI is more than 1.

- Internal rate of return (IRR) is also used to determine if a new project or initiative should be undertaken.

- All one needs to do is to find out the present value of future cash flows and then divide it by the initial investment of the project.

- PI ratio compares the present value of future cash flows from an investment against the cost of making that investment.

- A PI greater than 1.0 is considered a good investment, with higher values corresponding to more attractive projects.

- Next, in another cell, we add the absolute value of the initial investment amount to the NPV value.

The accuracy of PI also hinges on the reliability of projected cash flows and the chosen discount rate. Optimistic forecasts can skew PI toward seemingly lucrative but ultimately unprofitable ventures. Comparing projects with different lifespans and cash flows can be challenging, but the Profitability Index provides a level playing field for such analyses. For projects with different durations, we normalize the potential profitability by calculating an equivalent annual annuity. This adjustment ensures we’re comparing apples to apples by considering the time horizon of returns. To calculate NPV all, we need to do is to add up all discounted cash flows and then deduct the initial investment required.

A PI greater than 1 indicates a potentially lucrative investment, while a value less than 1 signals a warning. This simplicity in interpretation makes PI a favored tool among financial analysts. The concept of the Profitability Index emerged from the need to evaluate the effectiveness of investments, incorporating the time value of money to ensure a comprehensive analysis. It evolved as a refinement of Net Present Value (NPV) calculations, providing a dimensionless ratio that simplifies comparison between different-sized projects. In other words, the present value of cash flows is divided by the initial investment to give you the PI ratio. A PI ratio greater than 1 means that your investment is profitable, while a PI ratio less than 1 means that your investment is not profitable.

Calculations less than 1.0 indicate the deficit of the outflows is greater than the discounted inflows, and the project should not be accepted. A ratio of 1 indicates that the present value of the underlying investment just equals its initial cash out outlay and is considered the lowest acceptable number for a proposal. A less than 1 PI ratio means that the project’s present value would not recover its initial investment or cost.

This accounts for the time value of money, a crucial principle in finance that reflects the idea that money available today is worth more than the same amount in the future due to its earning potential. The Profitability Index Calculator offers numerous benefits to investors seeking to evaluate investment opportunities. Firstly, it provides a clear and objective measure of a project’s profitability, allowing investors to compare and prioritize different ventures. Moreover, this tool facilitates efficient resource allocation by highlighting projects with higher profitability indexes, enabling investors to allocate their financial resources strategically.